Buying a car means being able to go wherever you want, whenever you want. A vehicle affords you a host of personal and career opportunities that would otherwise be impossible. On average, Canadian drivers change cars every seven years, but for many people, that is too long. They want to change more often! They want a more spacious, more comfortable or more efficient car that is in line with their financial situation. That is where the trap of negative equity—a controversial practice leading to excessive debt—awaits you. What does negative equity mean? Read this article for everything there is to know on the matter.

Negative equity is still poorly understood, but it’s really simple! Negative equity is the difference between the remaining amount on your car loan and the market value of your vehicle. If the amount remaining on your loan is greater than the value of your car, you are at a point of negative equity. In other words, you owe more than the current value of your car. Now what is balloon financing? This is a term often used when referring to a negative equity position. It means the negative equity amount from your old loan is being refinanced through your new loan. So the balance of your new loan includes not only the amount to be paid on your new vehicle, but the remaining debt on your old loan. It may seem harmless, but being in a significant negative equity position could be very damaging to your credit rating and affect your ability to borrow in the future.

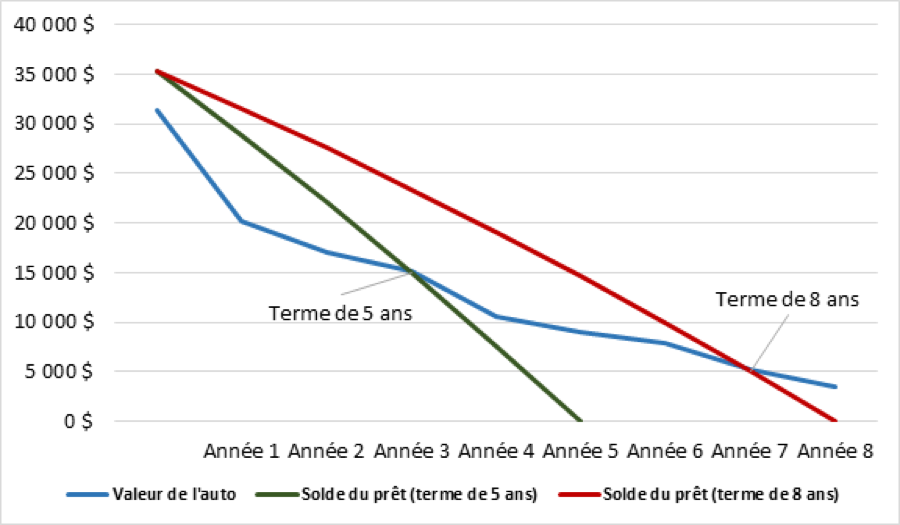

For a better understanding of negative equity, it’s important to understand how cars depreciate. Here is a graph showing the rate at which a car loses its value:

GRAPH

Chart showing the depreciation of an automobile valued at $ 35,000 which will be worth $ 15,000 after 5 years and $ 5,000 after 8 years.

|

SOURCE TEXTE

|

TRANSLATION |

| 40 000 $ | $40,000 |

| 35 000 $ | $35,000 |

| 30 000 $ | $30,000 |

| 25 000 $ | $25,000 |

| 20 000 $ | $20,000 |

| 15 000 $ | $15,000 |

| 10 000 $ | $10,000 |

| 5 000 $ | $5,000 |

| 0 $ | $0 |

| Année 1 | Year 1 |

| Année 2 | Year 2 |

| Année 3 | Year 3 |

| Année 4 | Year 4 |

| Année 5 | Year 5 |

| Année 6 | Year 6 |

| Année 7 | Year 7 |

| Année 8 | Year 8 |

| Terme de 5 ans | Five-year term |

| Terme de 8 ans | Eight-year term |

| Valeur de l'auto | Value of the car |

| Solde du prêt (terme de 5 ans) | Loan balance (five-year term) |

| Solde du prêt (terme de 8 ans) | Loan balance (eight-year term) |

Here’s an example to help you understand:

Shawn bought a two-passenger car with the help of a $20,000 car loan when he met Laura three years ago. He negotiated a 60-month term and a 6.99% interest rate with monthly payments of $396. Now, following the birth of their son Liam, he is back at the dealership wanting to buy a four-door subcompact SUV with enough room for the new member of the family. The model and options Shawn wants are estimated at $35,559, including taxes. However, he has $9,500 remaining on his initial loan. The dealer offers a trade-in value of $6,500 for his car (based on the Canadian Black Book ). He also offers to finance the $3,000 difference, the “balloon” from his current debt, on the new loan. So Shawn has to finance $35,559 + $9,500 - $6,500 = $38,559.

Shawn’s debt has gone from $9,500 to $38,559, and that doesn't include the interest on the loan. Although the 4.99% rate is lower than that of his previous financing arrangement, once the interest has been calculated, his new financial commitment will be a total of $46,845. To be able to afford this undertaking, Shawn decides to pay it off over the longest period possible, 96 months, with monthly payments of $488.

Not only will Shawn have to pay back a larger sum than the value of his asset, but the asset will result in damaging debt. His new monthly payment is $488 versus $396, and it’s over an eight-year period.

It should be pointed out that the vehicle he just bought will start losing value the minute he drives if off the dealer’s lot. And since the repayment of his loan is linear, the vehicle will continue to lose value each year.

The only advantage of balloon financing is that it allows you to buy the vehicle you want, despite an existing debt. This practice looks simple on paper, but be careful—as one balloon often leads to another. A car loses value each year, but your debt doesn't shrink accordingly.

There are several risks involved in accruing negative equity on an asset. For example:

Scenario #1

Shawn has to do renovations after getting some water damage in his basement. He will have to sell the SUV to be able to do the renovations without getting into a money pit. His vehicle has depreciated and its market value is less than what he paid for it. In addition, he is likely to still be in debt after the sale. And he’ll no longer have a car!

Scenario #2

Shawn got into an accident with the SUV when returning from his night shift at the plant. Since he did not choose the replacement value option on his auto insurance policy, his insurer issues a cheque for $17,300, the current value of his vehicle. As a result, Shawn finds himself with a vehicle that is worth less, in spite of the fact that he still owes close to $30,000 on his damaged SUV. In the end, he will have paid for a standard vehicle at the cost of an SUV, because of his negative equity situation, and an accident for which he was not at fault.

Scenario #3

Shawn doesn't like his subcompact SUV, because he doesn’t have the space he needs for his tools, hockey equipment and Liam’s things. He wants something bigger, thus more expensive. Since he is already in a negative equity position, Shawn will have to finance his existing debt in addition to the loan needed to buy his new SUV. This means he will once again have a much larger debt, which will hamper his access to credit in the years to come.

The financing of negative equity is a controversial practice condemned by a number of institutions, but it is legal. According to the Office de la protection du consommateur (consumer protection office), it involves two independent transactions and the first debt belongs to you.1 The vehicle you're paying for belongs to the financial institution until you have paid it all off. But the debt on it is completely yours, and you are free to do what you want with it.

A dealer who offers to finance your debt on a new loan must, however, inform you of the implications under section 148 of the Consumer Protection Act. Being in a negative equity position is not necessarily disastrous. Perhaps it’s necessary, as in the case of Shawn above. Refinancing a car loan on a second larger loan is not something you decide on lightly. You have to consider the implications over the long term and on other purchases you may want to make. We strongly advise against this practice, but the choice is yours—and you are now better informed.

How can you protect yourself against getting into a negative equity position?

• Stick to your budget. If you have $450 for your monthly instalments, choose a vehicle that is within that limit. For example, with a $24,000 vehicle financed over five years, you will not only be able to hold on it, but this price will give you an extra cushion to deal with the unexpected.

• Make additional payments when you have the opportunity. That will allow you to reduce the term of your loan and the amount of interest paid.

• Be patient. Despite depreciation, every vehicle eventually reaches a point where its residual value is greater than the remaining value of the loan. That’s the point at which it makes sense to trade your car in for a new vehicle .

• Sell your vehicle privately. You will get a better price than you would get from the dealer, who has to provide a warranty and make a profit.

i http://www.canadianblackbook.com/